[GreenBiz publishes a range of perspectives on the transition to a clean economy. The views expressed in this article do not necessarily reflect the position of GreenBiz.]

Stakeholder value creation is a popular topic these days, with many CEOs claiming their companies are focused on creating value for all stakeholders in the interest of generating long-term business value.

But it can be difficult to determine which companies are walking the talk on stakeholder value creation. One way is to look at a company’s board’s terms of reference. A quick check will tell if the board has explicit oversight of the company’s relationships with stakeholders and the value the company is intentionally creating for them.

If this oversight role is missing — as it often is — you’ve found a stakeholder governance gap.

With investors looking closer than ever at how companies create value for stakeholders, this gap won’t last long. Companies must move from paying lip service to full service when it comes to stakeholder value creation.

Investors step up on stakeholder awareness

In his 2022 letter to CEOs of the companies in which he invests, BlackRock CEO Larry Fink opined:

Stakeholder capitalism is not about politics. It is not a social or ideological agenda. It is not “woke.” It is capitalism, driven by mutually beneficial relationships between you and the employees, customers, suppliers, and communities your company relies on to prosper…

In today’s globally interconnected world, a company must create value for and be valued by its full range of stakeholders in order to deliver long-term value for its shareholders. It is through effective stakeholder capitalism that capital is efficiently allocated, companies achieve durable profitability, and value is created and sustained over the long-term…

Putting your company’s purpose at the foundation of your relationships with your stakeholders is critical to long-term success…

Our conviction at BlackRock is that companies perform better when they are deliberate about their role in society and act in the interests of their employees, customers, communities, and their shareholders.

It remains to be seen how BlackRock will operationalize its interest in companies that put their purpose at the foundations of their stakeholder relationships. But this is a significant investor signal.

Another powerful investor signal comes from Focusing Capital on the Long-Term (FCLT), a global nonprofit organization whose members are leading companies and investors. It collaborated with the Wharton University of Pennsylvania to determine if implementing a multi-stakeholder strategy generates a financial return. If it does, then boards of directors will have a fiduciary responsibility to ensure an effective stakeholder strategy is in place. Its report, “Walking the Talk: Valuing a Multi-Stakeholder Strategy,” analyzed the annual reports of over 3,000 global companies and found that those with strong stakeholder language generated 4 percent higher returns, were more likely to invest in research and development, generated higher sales growth and delivered more stable returns.

The authors say that future-fit, long-term companies pay attention to a broader group of stakeholders to thrive. The report concludes that using corporate purpose as the reference point for deciding which stakeholder expectations matter to the corporation puts a multi-stakeholder strategy into practice more consistently. Firms that connect their purpose to key stakeholder responsibilities systematically across their organizations are better able to sustainably deliver long-term value, the authors write. Last month in GreenBiz I wrote about the role of the board in oversight of corporate purpose, in an article that elaborates on these ideas..

The stakeholder value proposition is surfacing and with it a fiduciary responsibility of boards to better understand how their firms are engaging with, creating value for and undertaking purposeful collaborations with stakeholders.

Corporate boards increase stakeholder oversight

Many company boards are starting to take a stronger oversight role of their corporate stakeholders. Airbnb’s board, for example, has approved a set of stakeholder principles and set up a board stakeholder committee. That group’s responsibilities include reviewing the company’s progress with respect to the stakeholder principles and conducting a periodic review of the company’s performance against its stakeholder metrics.

These rising expectations and best practices are unpacked in my firm’s report, “Purpose and Stakeholder Governance Best Practices: Literature Review and Guidance on the Board’s Role in Purpose and Stakeholder Oversight.” As with purpose governance, there is evidence that governance professionals, academics, investors, professional services firms and governance and standards institutions agree the board has an important role to play in providing oversight of a company’s stakeholder relationships.

This includes oversight of the company’s stakeholder strategy, culture, and measurement and reporting on strategic progress. Effective boards need to be expert in recognizing ways that their companies’ interests could adversely impact stakeholders and seek to resolve these tensions in creative and generative ways while considering stakeholders as resources for innovation and transformation.

Research reveals that boards need to confirm that management has robust processes for identifying relevant stakeholders and their material interests, that management reports to the board on its stakeholder engagements, and that the company’s compensation policies and performance measurements include a stakeholder component. The board should also ensure the CEO has stakeholder competencies, including the strategic acumen and agility to create stakeholder value.

As pointed out by BlackRock, FCLT and others, companies need to put their purpose at the foundation of their stakeholder relationships to foster long-term success. And boards have a critical role to play to ensure this.

A new model for full-service stakeholder governance

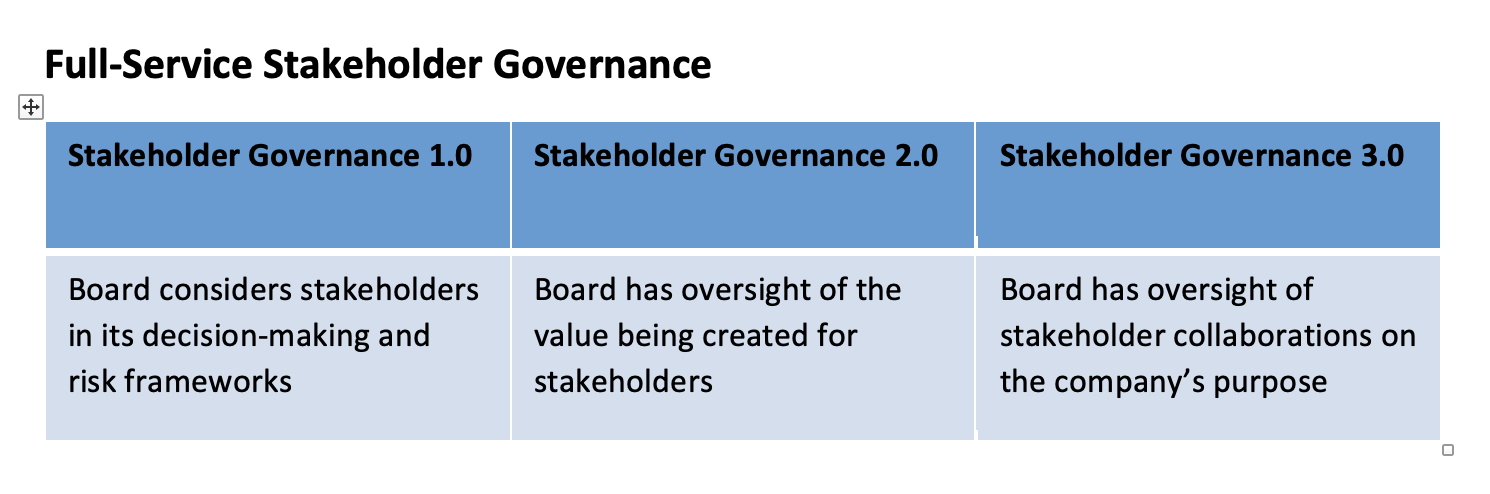

I propose a new model for full-service stakeholder governance, which has three stages. Stage One is when boards go beyond conventional approaches to considering stakeholders in their decisions. Stage Two is when they provide oversight of the company’s stakeholder value creation model. Stage Three involves stakeholder collaborations on the company’s purpose.

Going forward, more boards will need to build their competency and oversight in this area to fulfill their fiduciary responsibilities. Here is a guide I created that boards and their advisers can use to create a stakeholder governance roadmap and position the company and its stakeholders for success: “Purpose and Stakeholder Governance Playbook: Your Guide to Enhancing Your Board’s Oversight of Purpose and Stakeholders.”

The full potential of stakeholder collaboration won’t be realized until boards take up their proper oversight role of the company’s stakeholder relationships. Then, and only then, will the company’s long-term value creation prospects be fulfilled.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://www.greenbiz.com/article/case-giving-full-service-attention-stakeholder-value-creation