As famed investors David Einhorn and Jim Chanos once said, “Anyone who has bet against Elon Musk has lived to regret it.” Unfortunately, the short sellers did not heed this advice. Now, they’re feeling the heat as Tesla surged for the second day in a row.

Late last year, Tesla stocks were trading at an all-year low. It didn’t take long before Tesla short sellers piled on the stocks and netted a profit of $11.5 billion at the end of the year. The free fall did not stop there. On January 3, Tesla stock reached its lowest point trading at $108.10 per share. But that was the end long-year party for short-sellers.

On January 25, Tesla reported better-than-expected fourth-quarter revenue of $24.32 billion vs the $24.16 billion expected by Wall Street analysts. The world’s largest electric maker was rewarded by investors as Tesla’s shares rose by about 15% in the first hour of trading Thursday.

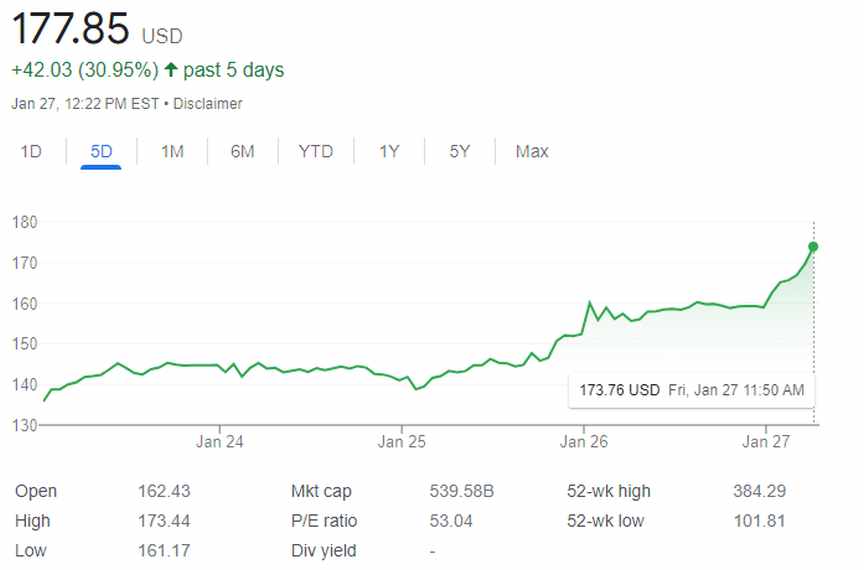

But the rally didn’t end there. Today, Tesla stock surged by another 11% hitting its highest point since November 2022. Analysts described the Tesla stock moves a hint at positive signs for the market.

In the past five days alone, Tesla stocks have risen by over 30 percent and now trading at around $178 as of the time of writing. The latest surge has sent short-sellers scrambling to cover their positions.

Despite the good news, Musk offered a cautioned but optimistic outlook for the company’s production in 2023. “If it’s a smooth year, without some big supply chain interruption or massive problem we have the potential to do 2 million cars this year. I think there would be demand for that, too,” Musk told an analyst.

In the fourth quarter, the electric vehicle maker beat Wall Street targets in its fourth-quarter revenue and profit on Wednesday despite a sharp decline in its profit margins. According to financial market data firm Refinitiv, Tesla had revenue of $24.32 billion vs the $24.16 billion expected. Its adjusted earnings during the quarter were $1.19 vs the $1.13 per share expected. The total revenue during the quarter includes $21.3 billion in automotive, $1.78 in services, and $1.311 billion from energy generation and storage.

The positive news comes just a few months after Tesla cut the prices of its cars in China and the United States in late 2022. The earnings also come as Tesla sought to reassure investors that it can cut costs and still continue to generate cash as competition intensifies from other electric car maker rivals. Tesla’s shares ticked higher in the after-hours market.

In an earnings call with shareholders and analysts on Wednesday, Tesla CEO Elon Musk said, “Thus far in January we’ve seen the strongest orders year-to-date than ever in our history. We’re currently seeing orders of almost twice the rate of production.”

In recent years, Tesla has outperformed the industry and has also seen increased sales and record profits. The company was also able to weather the pandemic of the last three years and global supply-chain issues better than its rivals. However, its automotive gross margins came in at 25.9%, the lowest figure in the last five quarters.

The reported automotive revenue of $21.3 billion in the fourth quarter, represents 33% growth year-over-year for the world’s largest electric car maker.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://techstartups.com/2023/01/27/tesla-stock-is-on-fire-and-shorts-are-feeling-the-heat-as-shares-pop-more-than-25-in-just-2-days/